Quick Summary:

- CMS finalizes rule allowing plan sponsors to utilize a Copay Accumulator Adjustment Program (CAAP) without restricting these programs to only branded drugs with an existing generic alternative

- CMS warned insurers they may be subject to strict member communication requirements in the future

Deeper Dive:

For context, I will provide a short synopsis of the Administration’s proposals this past year in the copay accumulator/maximizer world. Back in 2019, when CMS issued their 2020 ACA Notice of Benefit and Payment Parameters (NBPP) Proposed Rule, they sought to prohibit CAAPs for brand drugs lacking generic competition. This proposed rule was never finalized due to a conflict and the resulting confusion with an IRS notice from 2004 outlawing the contribution of coupon assistance towards deductibles in high-deductible/HSA plans. After tabling the subject for a year, CMS finalized rulemaking in their 2021 ACA NBPP Final Rule:

The rule allows CAAPs to be administered by health plans in the ACA and commercial market without restricting those programs to only brand drugs with an existing generic alternative as proposed the year prior.

CMS essentially gave insurers the go-ahead for CAAPs, likely leading to increased utilization of said programs in 2021.

In general, CAAPs fall into two types: copay accumulator programs and copay maximizer programs.

The accumulator programs came to market first and earn their reputation from the unexpected jump in patient cost-share during the year after the manufacturer support runs out leaving the patient exposed to the deductible/coinsurance with their medication.

Copay maximizer programs work by ensuring the full amount of the manufacturer-sponsored copay assistance is extracted for the plan while still ultimately applying the manufacturer support to the patients’ deductible and shielding them from the unpopular cost-share jump associated with accumulator programs.

Although the rulemaking endorsed CAAPs, CMS did warn issuers and group health plans that they’ll continue to encourage transparency and recommended prominent inclusion of CAAP information on websites and brochures. If written encouragement fails, CMS “may consider future rulemaking to require that issuers provide this information in plan documents.” This thinly veiled threat from CMS is likely to pop up in future rulemaking due to the dearth of consumer awareness around these programs.

Insights:

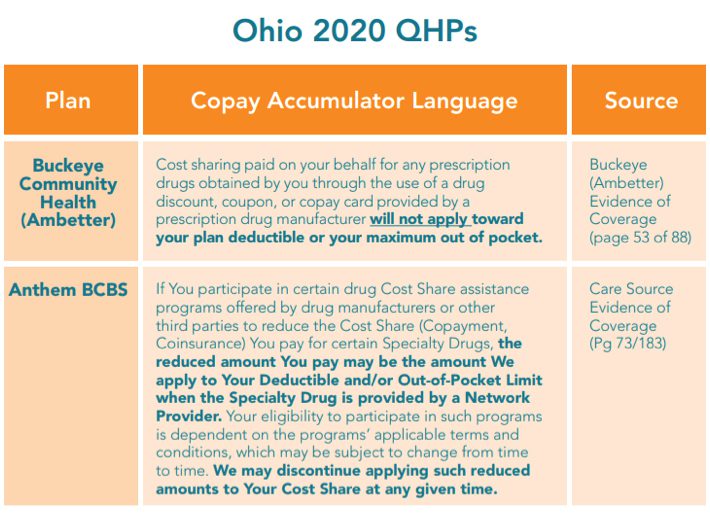

Earlier this summer, the AIDS Institute produced a report on CAAP communication transparency and the concurrent state regulation proposals surrounding them. The key takeaway is the complete lack of information provided to patients. This asymmetrical knowledge gap ensures patients go in blind to the enrollment process leaving many struggling without the copay support. The AIDS Institute found the following examples of verbatim language embedded in health plans’ “Evidence of Coverage.”

Figure 1: AIDS Institute: Examples of CAAP explanation language in “Evidence of Coverage” plans in Ohio

From a consumer perspective, the terms ‘confusing language’ and ‘lack of transparency’ would be fair assessments. Even though CMS has not come to that same conclusion, individual states have heard the noise and are taking up the fight against CAAP’s. According to the report, Illinois, Virginia, and West Virginia had all passed laws requiring insurers to count drug manufacturer assistance towards deductibles in 2019, with seven more states reviewing proposed legislation this year. The power of individual states is always limited by ERISA in cases like these (i.e. Rutledge v PCMA), leaving CMS holding the much bigger hammer (and favorable stance).

The green light from CMS will certainly increase CAAP utilization in the 2021 plan year. These programs may rise in popularity for self-insured employers after a Covid-laden year of lower profits and heightened spend sensitivity. Copay maximizer programs are highly likely to expand due to the minimal patient disruption and the strong relationships large payers have developed with private companies to roll out their CAAP offerings. Cigna/ESI has chosen to work with SaveonSP, while Caremark has chosen PrudentRx as their CAAP representatives as Drug Channel Institute outlined. Earlier this year UHC sent out the provider protocol for their “Accumulator Adjustment Medical Benefit program” requiring providers to submit specialty medication medical claims and manufacturer copay coupon reimbursement information, much to the dismay of provider groups.

The CAAP offerings may be especially punitive for specialty manufacturers more sensitive to prescription abandonment in accumulator programs and value extraction in maximizer programs. It will be important to monitor the impact of the CAAP market in 2021 to evaluate any recommended changes to coupon assistance offering strategies in response.

Timeline:

This rulemaking has been finalized for the 2021 contract year allowing insurers to employ these programs. On the commercial side, these programs can be implemented at any point throughout the year offering further incentive to monitor the market. Given the conflicting communication from CMS on CAAPs throughout the previous four years, it would stand to reason that this rulemaking may be subject to future changes. A new CMS administrator in 2021 could be singing a very different tune on these programs headed into the foreseeable future. Insurers may look to encourage CAAP utilization now to amass data in support of their programs for future conversations with CMS.

Contact Viking Healthcare Solutions for help with your strategic planning.

Viking Healthcare Solutions has established itself as the premier provider of corporate account services and strategic planning support for the pharmaceutical and biotech industries. VHS Insights, our research division, specializing in payer profiling, market research and analytics, can help you find answers to inform your payer strategy. We support traditional and rare/specialty organizations to create, maintain, defend, and protect access to your product throughout its lifecycle. Bank on our experience to help you achieve successful product commercialization. Contact us at www.vikinghcs.com/connect.