Quick Summary:

- Allows Medicare Advantage and Part D plans to offer a second specialty tier

- Requires that if there are two specialty tiers, one must be a “preferred” tier that offers lower cost-sharing than the maximum allowable cost-sharing

- Requires plan sponsors to permit tiering exceptions between the two specialty tiers

- Codifies a methodology to determine annually the specialty-tier cost threshold using ingredient cost and increases the threshold when certain conditions are met

- Regulation is effective March 22, 2021 and applicable for plans starting January 1, 2022

Deeper Dive:

On February 18, 2020, CMS issued a proposed rule focusing on changes in the Medicare Part D space for contract years 2021 and 2022. Some provisions were finalized in June of 2020, however, a few items were not finalized until January 15, 2021, when CMS issued the contract year 2022 Medicare Advantage and Part D Final Rule.

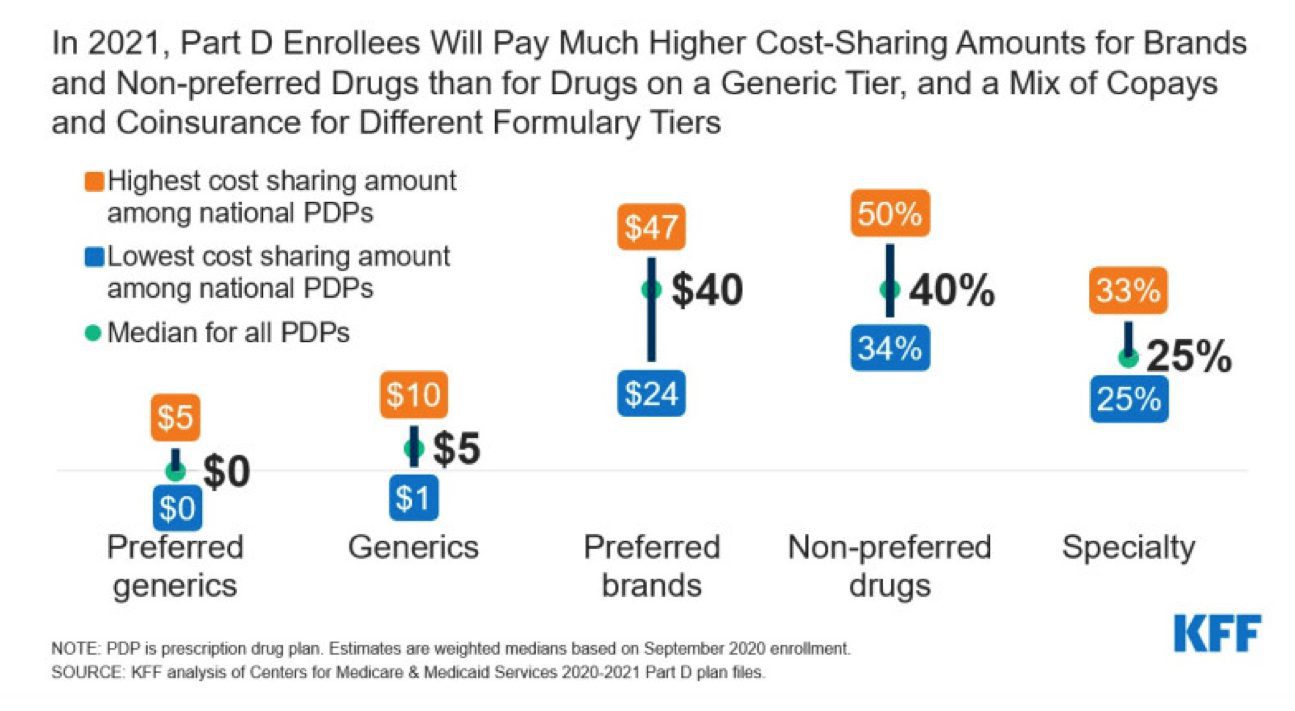

The final rule makes a significant change to rules governing Part D formulary design. Currently, CMS permits Part D plans to place drugs that cost over a specified threshold (for contract year 2021, $670/month) in a single specialty tier. Within the specialty tier, plans may charge higher co-insurance—up to 25 or 33 percent, depending on the plan’s deductible.

Under this final rule, Part D sponsors will have the flexibility to determine which Part D drugs are placed on either specialty tier, subject to the ingredient cost threshold and the requirements of the CMS formulary review and approval process.

Insights:

In the Final Rule, CMS finalized several rule changes related to the specialty tier in an attempt to maximize plan negotiating power while promoting access for beneficiaries.

Second Specialty Tier

Under the final rule, Part D plans may establish a second specialty tier, splitting specialty drugs between a non-preferred specialty tier and a preferred specialty tier, with the preferred tier carrying lower cost-sharing obligations than the non-preferred tier. By allowing plans to apply differential co-insurance obligations to specialty drugs, this dual specialty tier model is designed to give plans flexibility to incentivize beneficiaries to select lower-cost specialty drugs.

CMS does not specify the amount of lower cost-sharing that must be offered with the “preferred” specialty tier relative to the non-preferred tier. As for the non-preferred specialty tier, the rates will not increase beyond the current 25-33% coinsurance limitations (deductible dependent).

CMS did mention that commenters suggested that Part D enrollees stabilized on a specialty drug be exempt from unfavorable coverage changes (for example, increased cost-sharing) resulting from a secondary specialty tier. In response, CMS referenced the tiering exception process and the qualification that cost-sharing for patients only has the potential to decrease with the addition of a second “preferred” specialty tier.

In support of their final rule to allow for a second specialty tier, CMS references a 2016 MedPAC report advocating for the advent of two specialty tiers in promoting competition (rebating opportunities) and encouraging the use of lower-cost biosimilars. CMS posits the additional specialty tier would:

- Improve the ability of Part D sponsors and PBMs to negotiate better rebates and effectively encourage the use of preferred specialty-tier Part D drugs

- Reduce costs for Part D enrollees, not only through direct cost-sharing savings associated with a lower cost-sharing, “preferred” specialty tier, but also indirectly, through the lowered premiums for all Part D enrollees that could result from better rebates on specialty-tier Part D drugs’

- Reduce government costs directly through lower drug costs because lower cost sharing would delay a Part D enrollee’s entry into the catastrophic phase of the benefit in which the government is responsible for 80 percent of the costs.

Part D sponsors will be free to determine the placement of the specialty medications on the tiers. It would reason that Part D sponsors may aggressively pursue rebates for preferred placement on the specialty tier. Of primary concern for MedPAC is the explosion of patients through the Part D benefit to the catastrophic coverage in the federal reinsurance program. Oftentimes the highly rebated products gaining favorable coverage in Part D plans (thanks to the increased manufacturer required discount in the coverage gap phase and inclusion of that discount to the beneficiaries’ out-of-pocket contribution) explodes patients through the benefit. The manufacturer’s contribution to the enrollees true OOP allows plans to minimize their exposure to managing the drug costs while offloading them onto the manufacturer and the federal reinsurance program.

Through these dynamics, it would reason that, despite MedPAC hopes of biosimilar and generic specialty competition, some plan sponsors may use the preferred specialty tier to pursue aggressive rebate contracting with brand drugs. Even with these reasoned concerns, CMS is making the bet that increased contracting competition in the specialty tier will be fierce enough to lower overall plan/government costs, while also promoting increased access to specialty tier medications at a more affordable cost for beneficiaries.

Tiering Exceptions

Presently, specialty tier medications are not required to have a tiering exception from the specialty tier down to a “lower” non-specialty tier. Plans managing their formularies (every Part D plan) must maintain a benefit design actuarially equivalent to the Defined Standard and allowing a non-specialty tier exception “would likely increase costs elsewhere such as increased cost-sharing on generic drug tiers or increases in premiums.” In the final rule, CMS formally clarified that Part D sponsors may design their exception processes so that Part D drugs on the specialty tier(s) are not eligible for a tiering exception to non-specialty tiers to maintain actuarial equivalence.

With the addition of the second specialty tier, CMS will require each plan sponsor to develop an approved tiering exception process allowing for tiering exceptions from the higher “non preferred” specialty tier down to the “preferred” specialty tier. CMS believes that the addition of the second specialty tier “is unlikely to have a material impact on Part D costs” and will not alter the actuarial calculations that maintain the Defined Standard benefit requirements.

Specialty Tier Qualifications

To improve transparency, CMS codified current methodologies for cost-sharing and calculations relative to the specialty tier, with some modifications.

- Codifies maximum allowable cost sharing permitted for the specialty tiers to be between 25-33% depending on the deductible (No change to existing market)

- The specialty tier cost threshold for a given drug will be based on a 30-day equivalent supply of the ingredient cost reported on the prescription drug event (PDE) as opposed to the negotiated price of the drug.

- CMS will also adjust the specialty tier threshold annually to ensure that the threshold reflects the top one percent of drug prices, rounded up to the nearest $10.

- Finally, CMS will adjust the specialty tier cost threshold, in an increment of not less than 10 percent, when an annual analysis of PDE data shows that incremental increase is met for the top one percent of monthly ingredient costs.

In 2007, the specialty tier cost threshold was established at $500 per month roughly based on the average negotiated PDE price for the top 1 percent of claims. Since 2017, the specialty tier cost threshold has been $670 per month and the most recent guidance from CMS in 2018 stated that the specialty cost tier threshold would be based on similar methodology at the specific discretion of the Secretary HHS. To improve transparency and accountability for the recent surge in average specialty tier priced medications, CMS codified the process to adjust and rank PDE data for the top 1 percent of all drugs in the Part D program.

The threshold will be based on the 30-day equivalent cost rather than negotiated prices and any adjustment to the annual cost threshold for specialty tier placement will occur when the average price of the top 1 percent of medications increases 10% or more.

Using the methodology in this final rule and contract year 2019 PDE data, the specialty tier cost threshold for the contract year 2021 would be $780 as a 30-day equivalent ingredient cost. CMS chose not to implement the specialty tier cost threshold provision in CY 2021 thus pushing off the presumptuous specialty tier threshold increase up to $780 for CY 2022.

Based on their data, CMS estimates that the change from using the negotiated price to using ingredient cost will result in fewer than 20 drugs not meeting the $780 cost threshold for specialty tier. For 2022 manufacturers should consider if their 30-day ingredient cost is likely to exceed $780 and strategize accordingly.

Timeline:

The Final Rule was submitted in the final week of the Trump Administration. The current Administration did not re-open a 30-day public comment period or alter any of the rules during their “regulatory freeze” announced on January 20, 2021. With the bids due by June 2021 and the expiration of the 60-day regulatory delay period, the final rule is expected to remain unchanged for CY 2022.

With this Final Rule, the need for an effective market access strategy for specialty products in Medicare becomes even more crucial. Viking Healthcare Solutions may be the right partner to help you develop and implement an access plan that puts your specialty product on the formulary.

Contact Viking Healthcare Solutions for help with your strategic planning.

Viking Healthcare Solutions has established itself as the premier provider of corporate account services and strategic planning support for the pharmaceutical and biotech industries. VHS Insights, our research division, specializing in payer profiling, market research and analytics, can help you find answers to inform your payer strategy. We support traditional and rare/specialty organizations to create, maintain, defend, and protect access to your product throughout its lifecycle. Bank on our experience to help you achieve successful product commercialization. Contact us at www.vikinghcs.com/connect.